In the valley of silicon and tech,

A bank once stood tall and erect,

But a run on its funds caused it to fall,

A collapse that shocked one and all.Unless you have been living under a rock, the breaking news in from the last 72 hours is the following:

A Bank Failure Jolts Markets, Sending Stocks Down Sharply

The collapse of Silicon Valley Bank added to worries about the economy. The S&P 500 suffered its sharpest weekly decline of the year.

A Brief History of the Silicon Valley Bank

Silicon Valley Bank (SVB) was founded in 1983 by Bill Biggerstaff, a venture capitalist and bank. SVB's biggest clients are primarily technology and life science companies, including startups, venture capital firms, and private equity firms. Some of the well-known companies that SVB has worked with include Google, Apple, Tesla, and Amazon. However, SVB also works with smaller, emerging companies in the tech and life science industries, providing them with financial services and support to help them grow and succeed. The bank's business model was focused on providing specialized financial services to startups, including venture debt and venture capital financing. It grew rapidly in the 1990s as the tech industry boomed and expanded globally, with offices in the UK, China, and Israel. Some of the biggest VC firms that are creditors of SVB include Sequoia Capital, Andreessen Horowitz, and Accel. These firms have a strong presence in Silicon Valley and are known for investing in many successful technology companies.

What led to the Fallout?

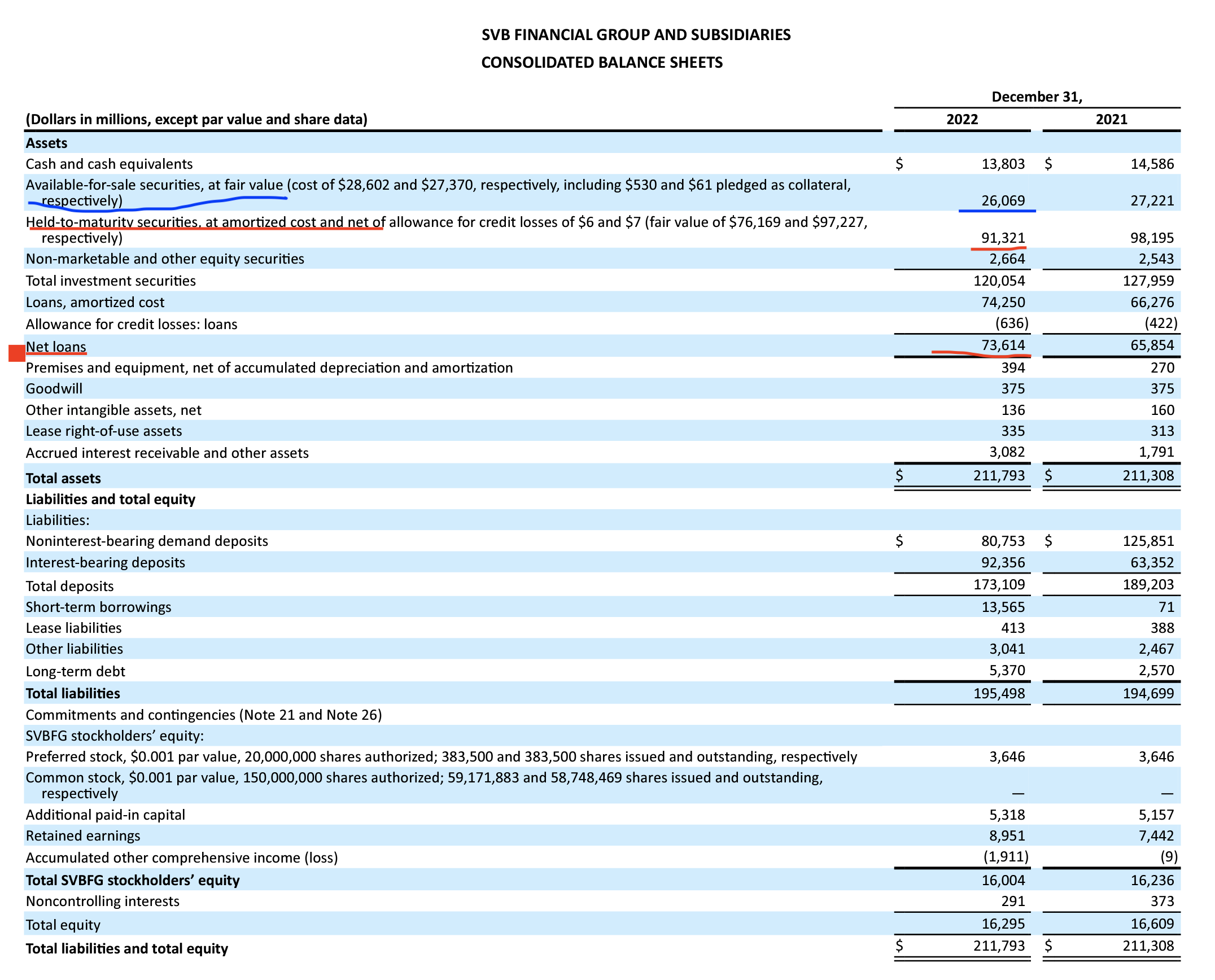

To understand the fallout of the Silicon Valley bank we first need to understand some key data from the bank's Financials.

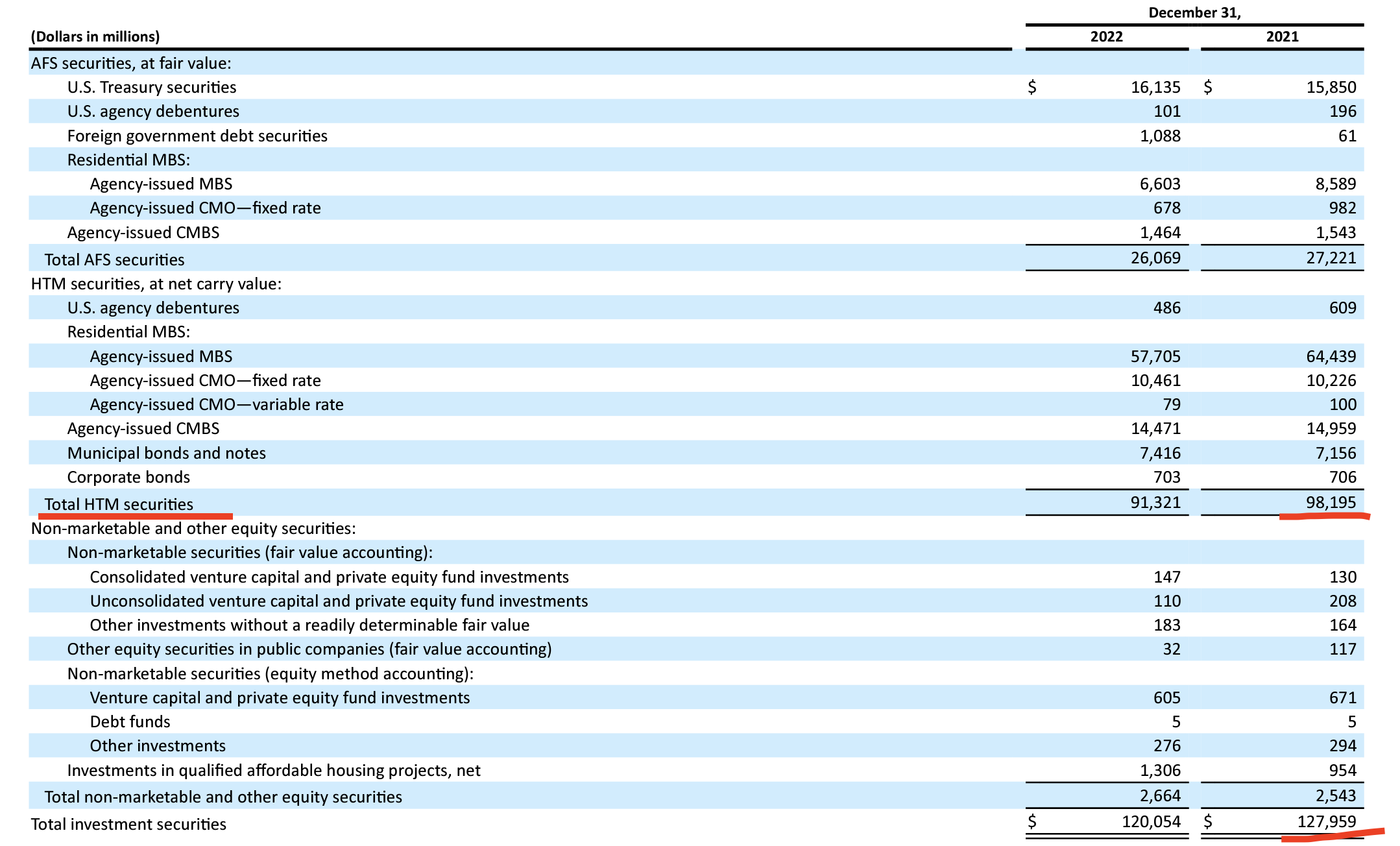

We will focus on the line item a) Available for Sale Securities b) Held to Maturity Securities c) Net Loans. These are the bulk coverage for the Total Assets of the bank out of which we can see that the investment in securities is quite high.

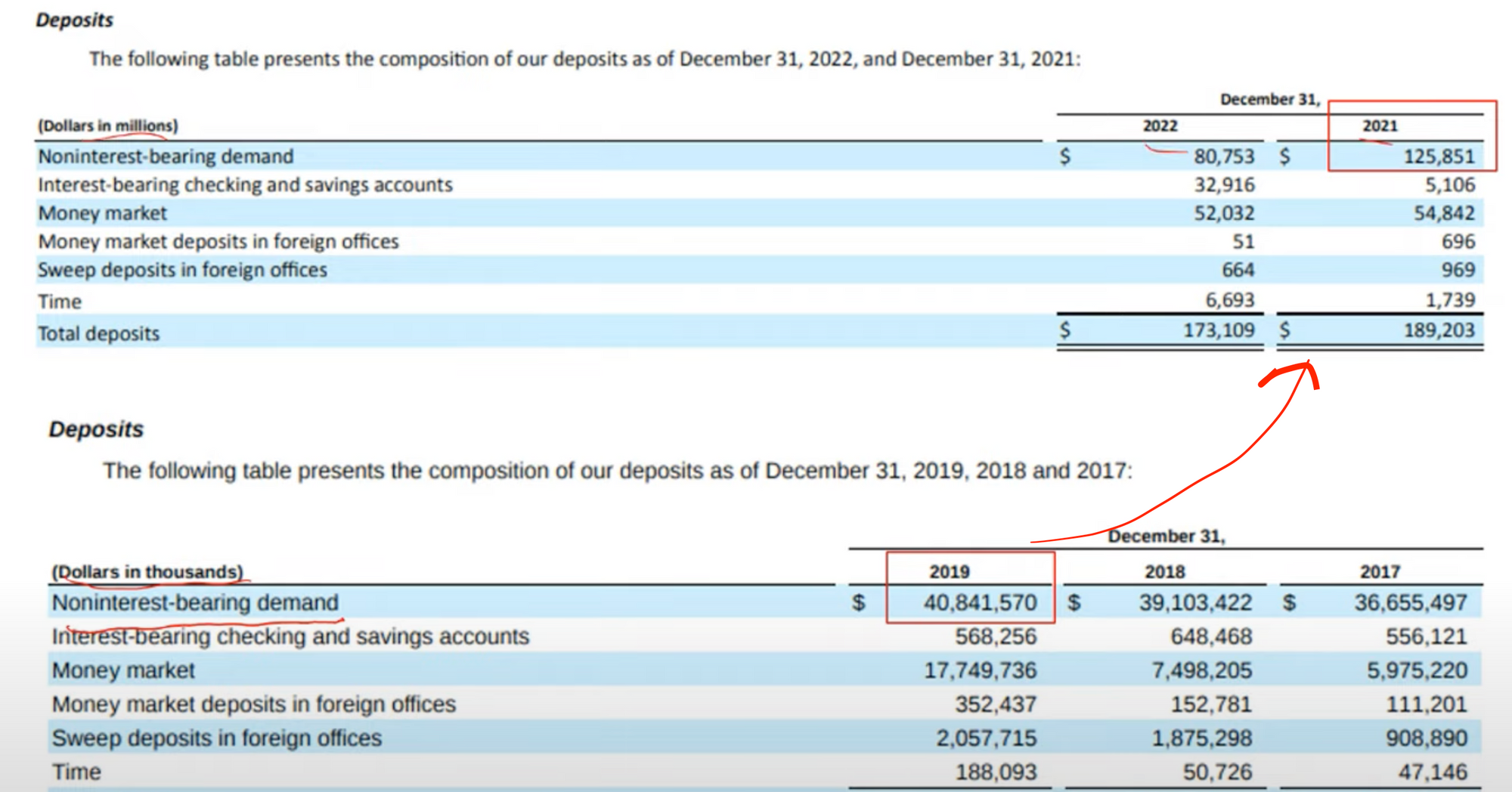

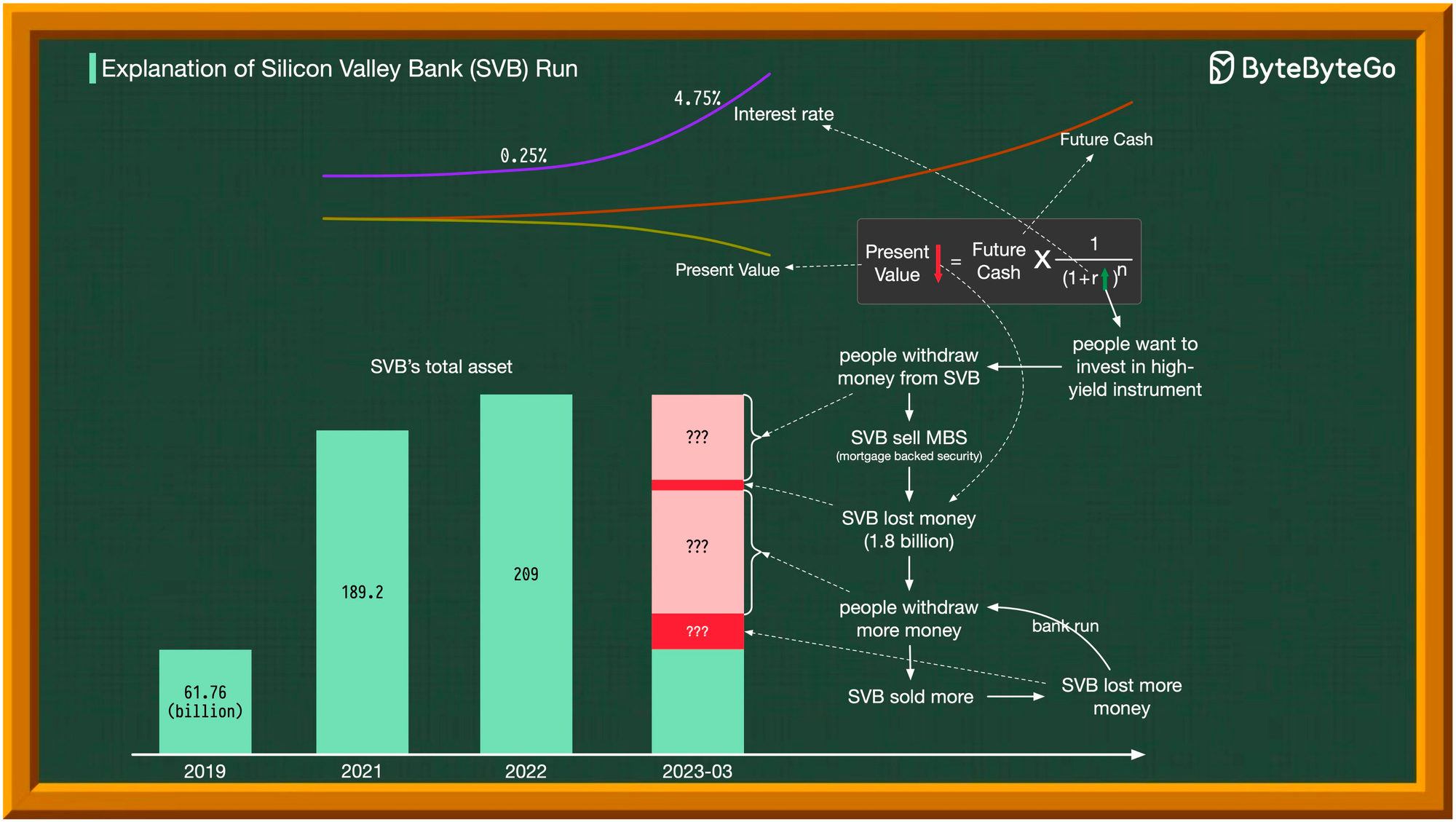

But let's take a step back to understand how did SVF get so much capital. As shown in the picture below, there was a massive influx of capital and funds in 2021. The deposits increased 3X from their 2019 numbers. It's of course natural for the bank to invest these deposits in safe financial asset classes in the best interests of the bank's business model but the market had other plans in their mind.

The money from the deposits at SVB was allocated (~77% ) in Bonds and Mortgage backed securities and treasury bonds.

Normally Treasury bonds are considered to be a safe asset class and is not expected to have much volatility, but unfortunately to the disbelief of SVB's investment strategies the bond prices dropped due to the rise in yield rates due to the monetary policies by the US Federal Reserve.

So how did the above decision impact them?

SVB invested in longer-term mortgage securities instead of shorter-term Treasuries or mortgage issues with maturity of less than five years, creating an asset/liability mismatch. As interest rates rose sharply and the bond market declined in 2022, SVB's bond portfolio suffered significant losses. At the end of 2022, the bank held $117 billion of securities, with $91 billion worth of the bond portfolio classified as "held-to-maturity" securities showing a loss of $15 billion, compared to just $1 billion loss in 2021. The yield on the portfolio averaged 1.6%, much lower than the current mortgage-securities yields of about 5%.

SVB suffered a significant loss due to their bond portfolio, but they did not have to recognise it because accounting rules allowed them to carry "held-to-maturity" securities at their cost. If the loss was recognised, it would have wiped out most of SVB's equity capital base. Investors and analysts did not pay much attention to this loss until recently, as they believed that the bank would be able to overcome the loss gradually as the bond portfolio matured over time.

The beginning of the end

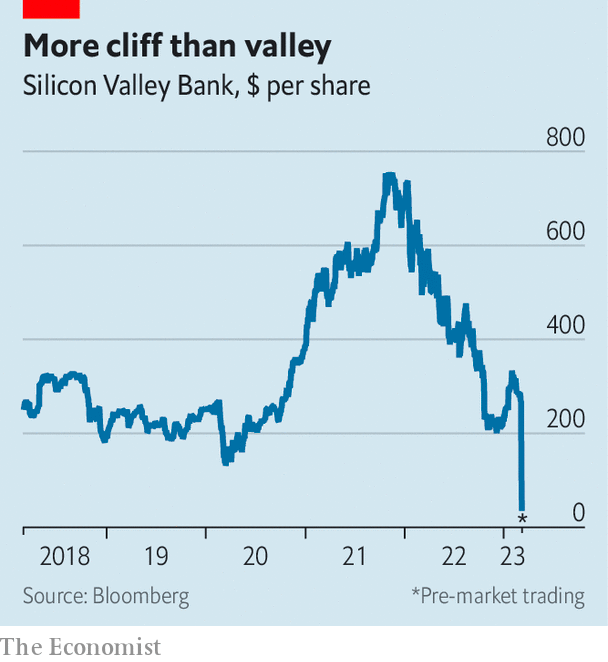

The bank accounted for the unrealised losses from the bonds and that led to the crash in their share price. This drove them to raise funds to cover their losses. General Atlantic even committed to $500m to purchase restricted common stock of SVB.

Inspite of all the efforts, SVB couldn't find investors to raise their required funds and adding fuel to the fire, Peter Thiel's following message is speculated to have triggered the bank run.

Bank Runs: Understanding their Causes and Effects

- During times of financial instability, people often seek the certainty of cash, leading to mass withdrawals from banks.

- A bank run occurs when this fear leads to a self-fulfilling prophecy of mass withdrawals and a loss of financial liquidity for the bank.

- Banks have limitations on physical cash reserves, making them vulnerable to bank runs during times of crisis.

- The Great Depression of the 1930s and the global financial crash of 2008 were both precipitated by a series of bank runs.

- Measures such as deposit insurance and regulations on fractional reserve banking have been put in place to mitigate the effects of bank runs, but they continue to be a risk during times of panic.

The impact

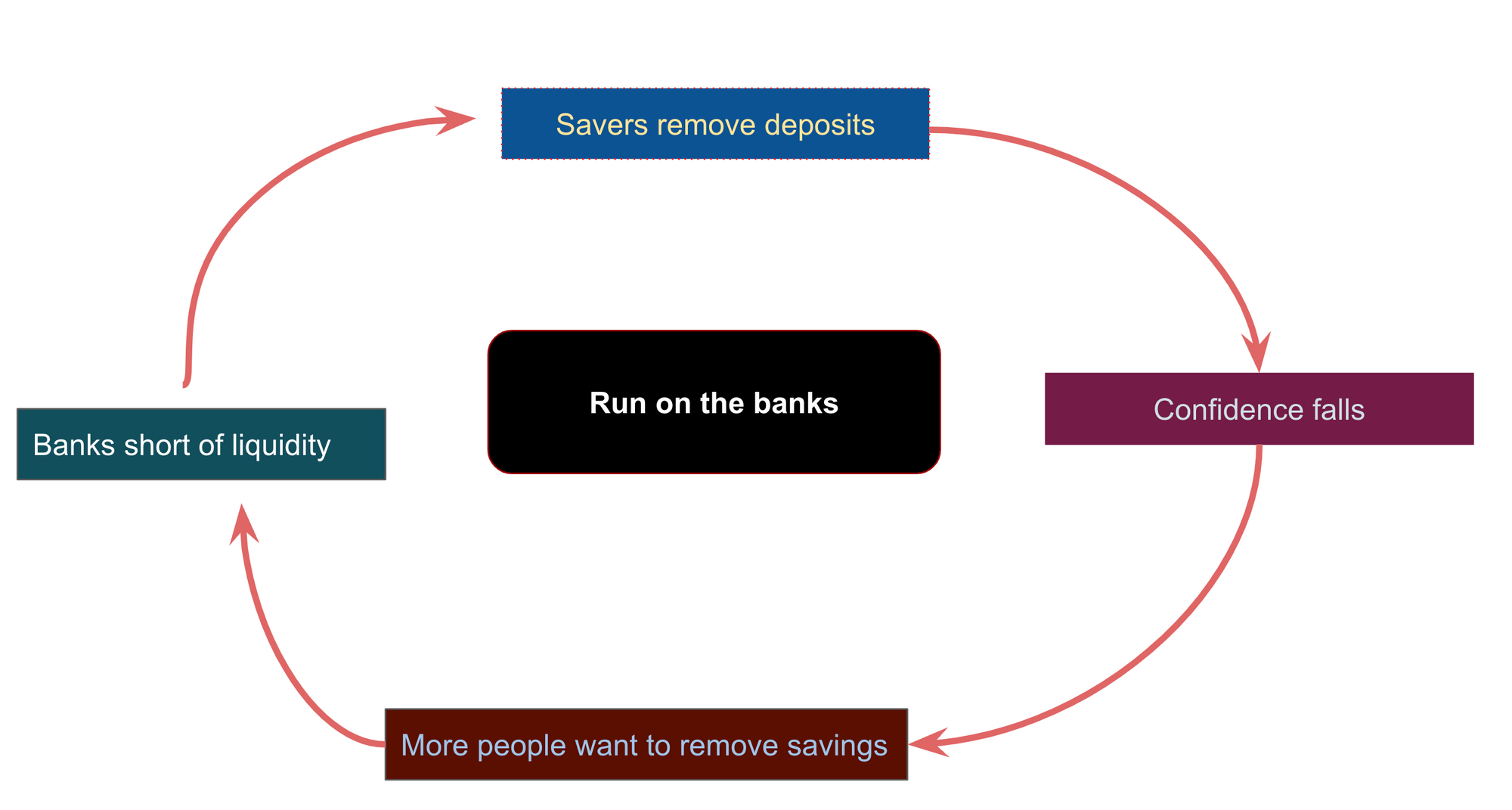

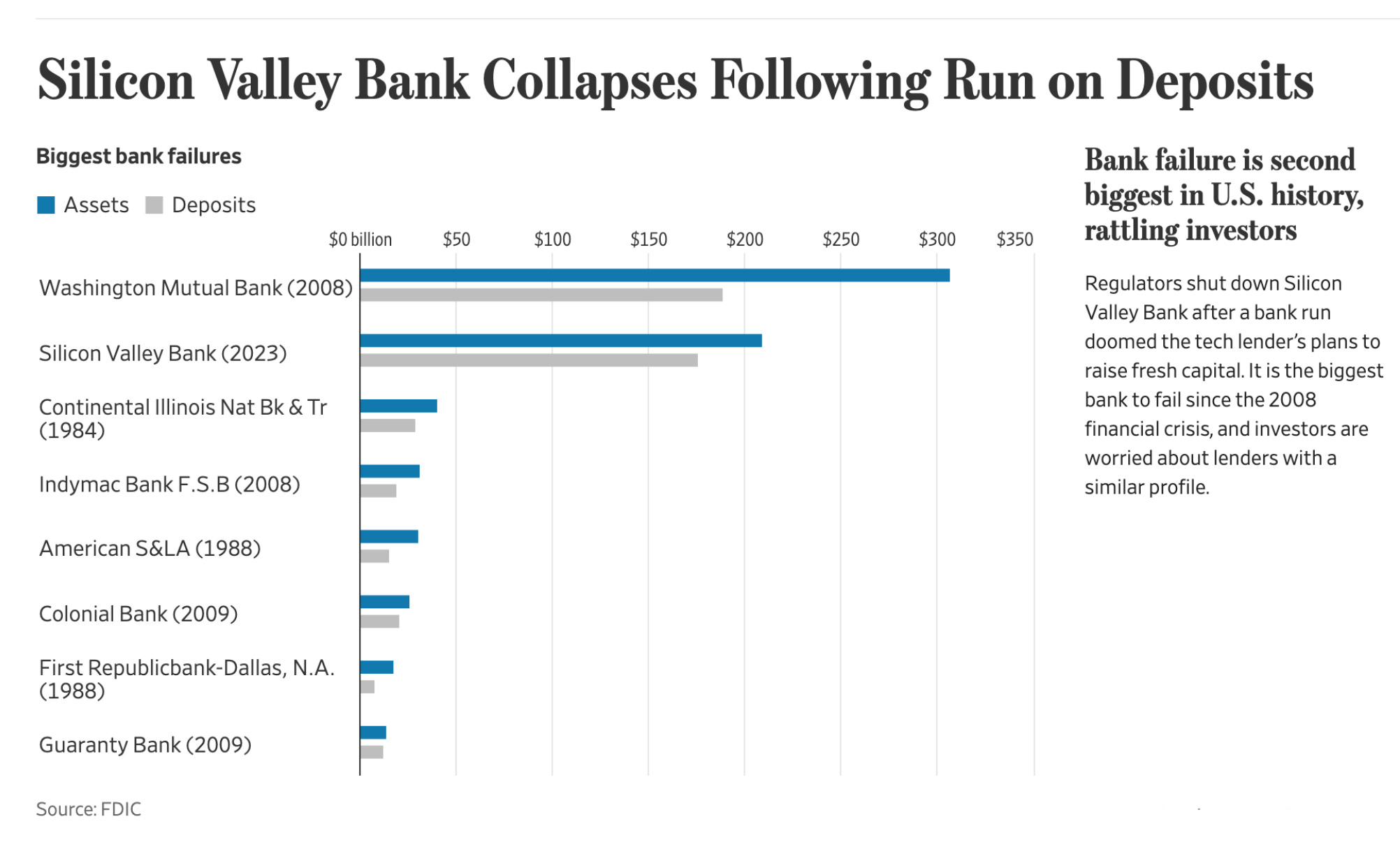

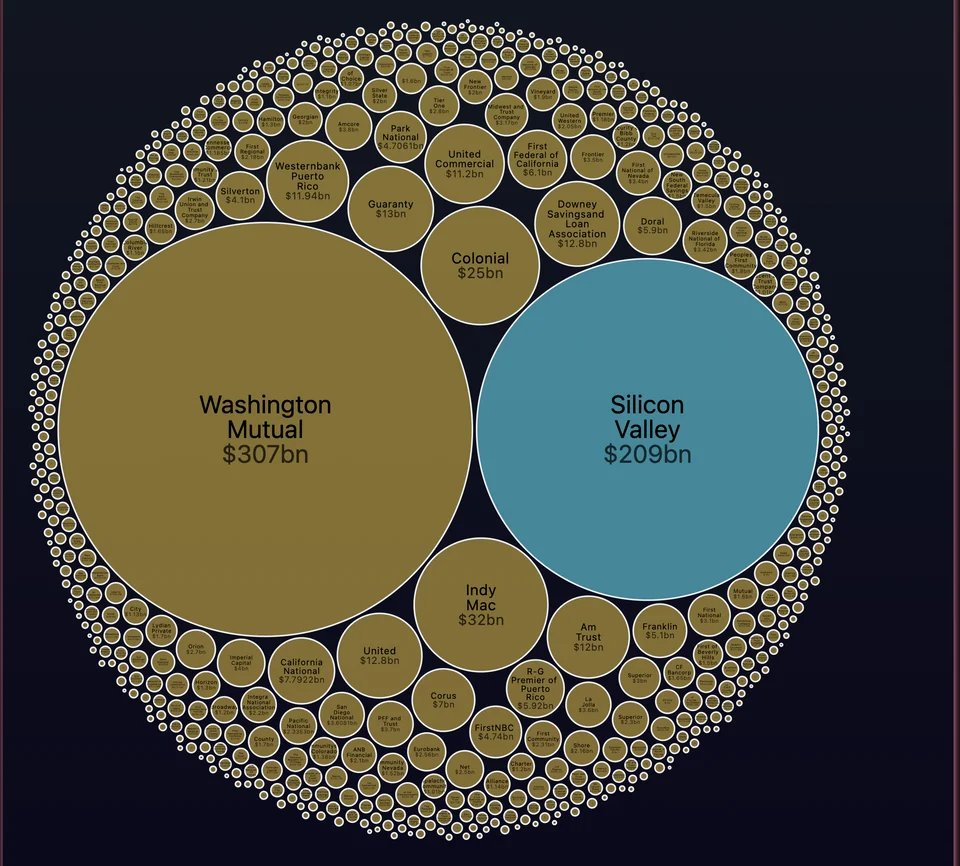

Silicon Valley Bank collapsed Friday morning after a stunning 48 hours in which a bank run and a capital crisis led to the second-largest failure of a financial institution in US history. California regulators closed down the tech lender and put it under the control of the US Federal Deposit Insurance Corporation.

The Contagion

As SVB's client base consists mostly of VCs and start-ups, the bank run is going to impact the industry, mostly affecting startups that are currently burning cash and are unable to access their funds to sustain their cash flow for operations. In other industries, the effect has already started to pop up.

Major VCs are already lobbying to stop this contagion as they fear this will have far bigger effect on the growth the US economy.

So to summarize in one picture as summed up by Alex Xu from ByteByteGo.

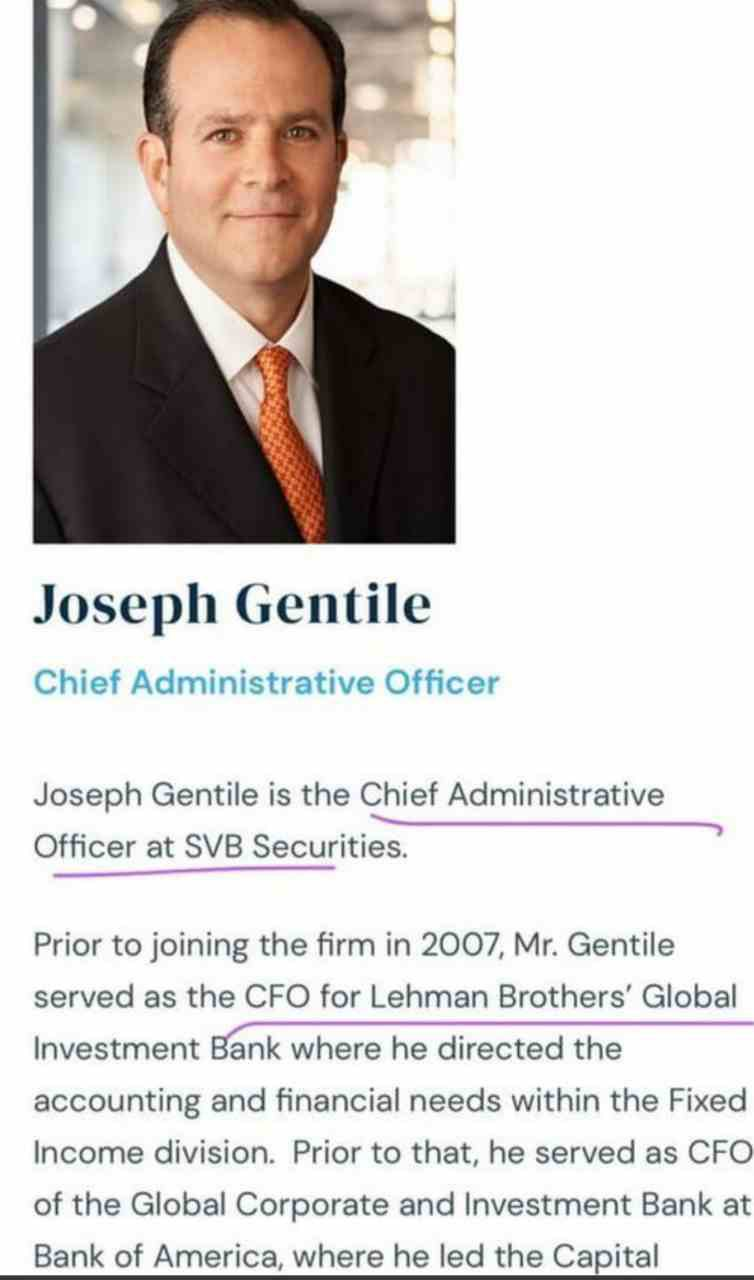

Oh yes, the irony in this story is not complete without the following mentions:

And closing by putting things into perspective

No clue what will happen with SVB, but I’m willing to predict one thing: finger pointing will begin about who’s to blame while hundreds of thousands of innocent depositor employees will wonder if they get paid next week. Politics over people is guaranteed.