Buying a house is somewhat of a dream that is baked into the mindset of the almost all the millennials. I too had a similar mindset until my I took some courses during my MBA at IESE and understood the answer to be, "It depends!"

This article is purely written into understanding different metrics from an investment point of view, "Should you buy a house as a financial investment?"

Why do we feel the urge to buy a house?

"Roof over (one's) head" : a place in which you can stay and find shelter.

The feeling of owning a property and the sense of security that you have a roof over your head has been a primal motive since the ancient times. Buying a house not only gives you that sense of security and ownership but also adds an elevated social status. It is the thin line which separates what is defined a house vs a home.

In the following sections I would be exploring different scenarios that influences the decision of buying a house and share my arguments on them.

[Assumption 1: Trying to buy the House in Mumbai, India]

Should you purchase a house when monthly mortgage = House rent?

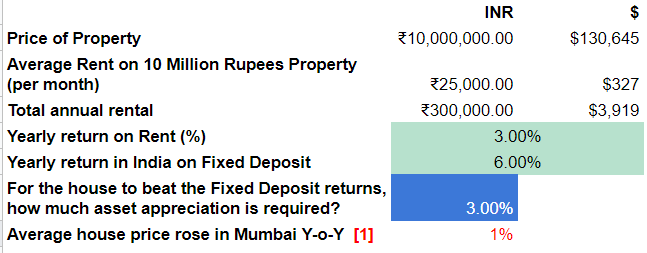

What the above table means, is that on a property that costs 10 million rupees to buy in India, the rental yield is worse off as compared to the alternate investment option of investing in a fixed deposit savings account. Adding to this, the yearly appreciation houses are a meagre 1%.

A follow-up question on this article is mostly, "The yield will normally increase after factoring the inflation".

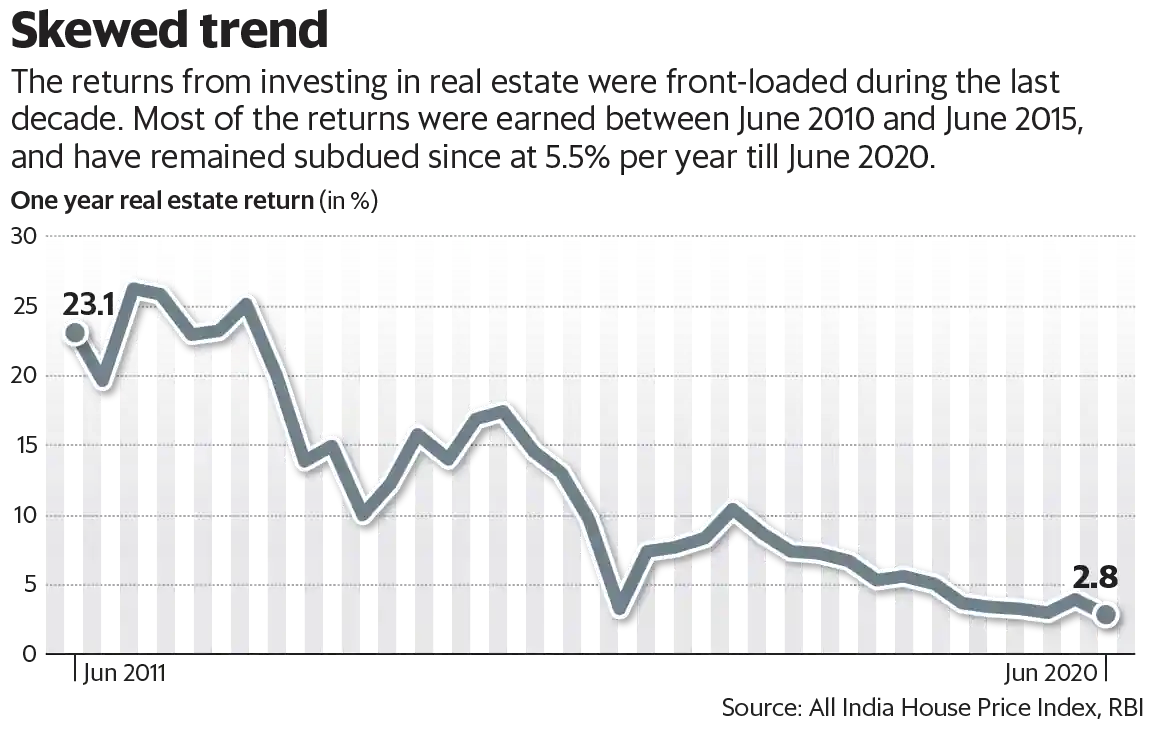

What this chart answers to the above question is the return on investment got front-loaded, meaning the growth happened in the last decade (or riding the wave of the surge in real estate yield). This rental yield was mostly due to the following factor of housing prices were not very high as opposed to the price a renter was willing to offer.

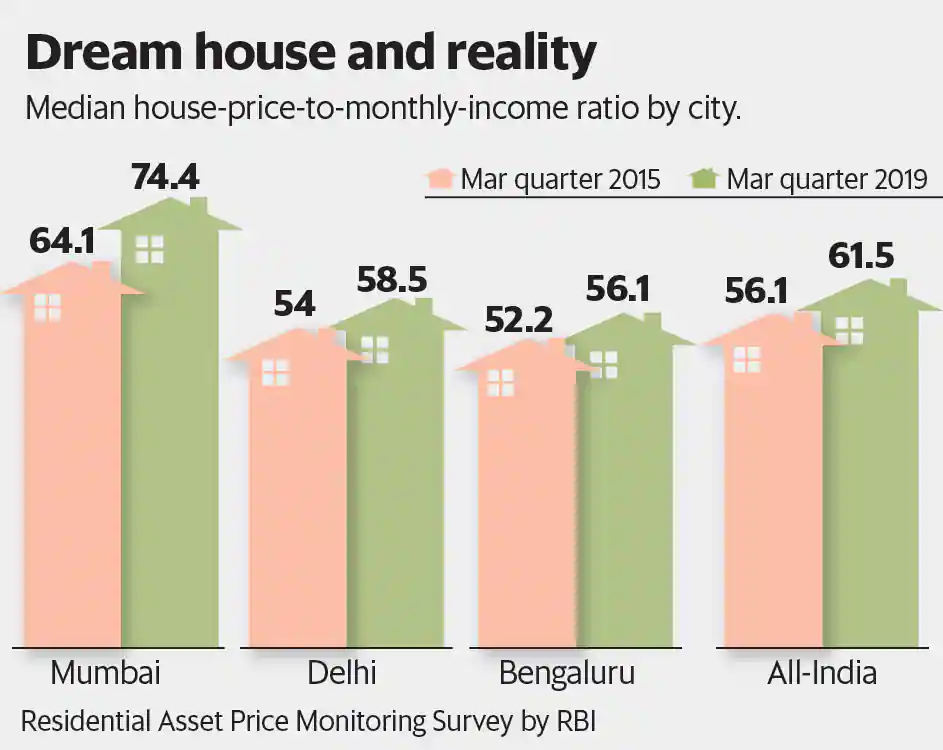

Price to Income Ratio : (Definition) is the basic measure for apartment purchase affordability (lower is better). It is generally calculated as the ratio of median apartment prices to median disposable income, expressed as years of income

What the above term means is how much would it cost for an average person to afford a house with their median monthly salary (If the salary is 50,000 p.m in Mumbai, then the cost of the house is 37million inr). This kind of gives an idea of how the property prices have inflated in the last few years.

What about the interest in housing loans are being quite low now?

If the argument is one should buy the house because of the interest being very low, then we need to understand why are the interest rates low?

This is because the government because of quantitative easing wants to boost up the spending and hence as reduced interest rates for almost all types of loans, from housing to corporate as well as consumer loans.

What this essentially means is an average consumer is buying an over inflated asset just because of the possibility to acquire cheaper loans with the strong assumption that the housing prices will go-up a lot in the future.

The fundamentals of Portfolio Diversification

/GettyImages-955416084-420be35104974f0b957a0bf72e4c485d.jpg)

Portfolio Diversification is essentially one of the fundamentals of Finance 101. It states clearly not to put "All your eggs in the same basket". Diversified portfolios helps to hedge against market downturns as well as keeps an overall attitude towards growth. [If you're not a proponent of Portfolio Diversification, then an assumption can be laid out that one has more information about the market].

The problem with trying to buy a house in India is that due to it's extremely high price, most of the money is spent in the mortgage which makes this essentially a high risky investment. The price-to-income ratio of India, forces an investor to tie 90-95% of their money in real estate while the remaining is left for other investments. Fundamentally it makes sense when you're able to buy the house with your savings.

[Myth buster: You never own the house, the bank is owning the house. Unless the EMI is paid off, you're essentially renting it from the bank]

Conclusion

From purely an investment stand-point, buying a house with the current market conditions in India doesn't seem to be a "wise investment decision". If you're buying it purely on an emotional aspect, then this article cannot do justice.

Stay tuned for the next follow-up article on " Should you buy a house? (Europe/ US/ etc)

Sources:

[4] https://www.youtube.com/watch?v=hqbMGuqtBuI&t=558s&ab_channel=AkshatShrivastava