The meteoric rise of Bitcoin has made a lot of financial gurus scratch their heads in order to make sense of its intrinsic valuation. While various analysts at hedge funds and investment banks have proposed a wide range of pricing, from $50K to $1m, calculating the intrinsic value of cryptocurrencies is always a challenge. The following empirical approach closely mimics the P/E valuation model for a traditional equities asset class.

What is the Price to Earnings (PE) valuation model and why do investors use them?

Before jumping into the valuation model, it's important to understand what is the purpose of using multiples. When you go to a butcher store to buy pork, beef, or chicken you try to understand the best bang for the buck. However, it’s difficult to compare the best value of the meat *be*cause the portion that you’ll be buying is different for each type.. But if you look at the Price per Kilo, then it will be easy for you to estimate the best value of your meat.

Investing in stocks comes with a lot of caveats. Some classic golden questions are, “Is this the right price to buy the stock?” or “When should I sell my stock?”. Honestly, it’s not easy to determine, “Is the price of the stock low?”.

PE ratio is considered as a multiple where we normally compare the price of a stock to its earnings. It tells you how much you’re paying for each dollar of earnings. Let’s break this down to understand what it means.

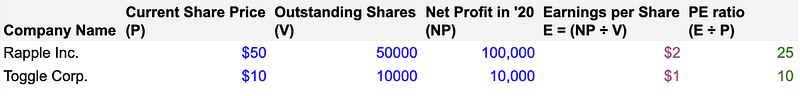

Suppose there are two companies, Rapple Inc. and Toogle Corp. Both of them sell snow shovels in the USA. Rapple’s shares trade at $50/share while Toggle’s shares are being traded at $10/share. A new investor might think that Toggle’s stock is undervalued but this is not necessarily true. A low share price doesn’t mean the stock is undervalued. A stock is undervalued if its price is low relative to the amount the company earns. Let’s say Rapple Inc is located in Winsconsin which gets a lot of snow. They have a profit of $100K per year; while Toggle Corp which is located in Texas which doesn’t get a lot of snow and earns $10K per year. Rapple Inc has issued 50K outstanding shares, while Toggle Corp has 10K outstanding shares.

But PE ratio cannot intrinsically define if a stock should be bought or not. It's important to understand the PE ratio in its context. For example, Toggle Corp. has a lower PE ratio because of its limited growth potential of selling snow shovels in Texas. However, if both companies are expected to grow at similar rates, then Toggle Corp. can be a better value to buy based on its PE ratio.

So, can we have a PE model for cryptocurrencies?

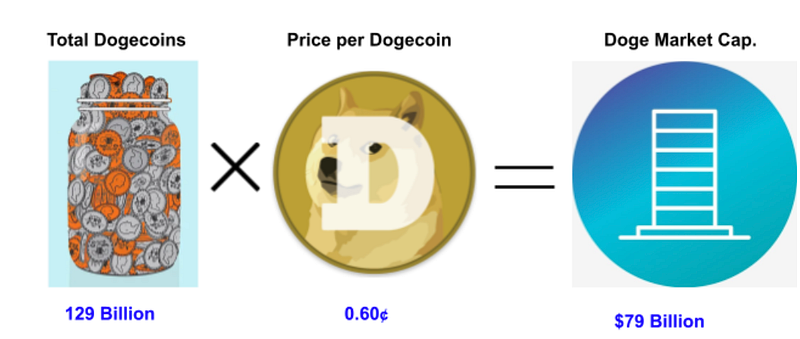

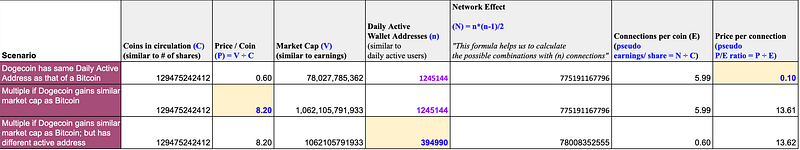

What this model is trying to do, is establish an empirical approach to analyze and compare different cryptocurrencies based on their market cap (since cryptos don’t generate earnings, we will use this as a reference), number of coins in circulation (analogous to issued shares), price per coin (similar to the price of shares).

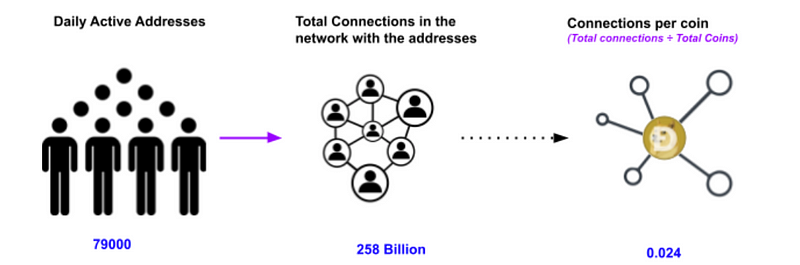

Visually interpreting the above model

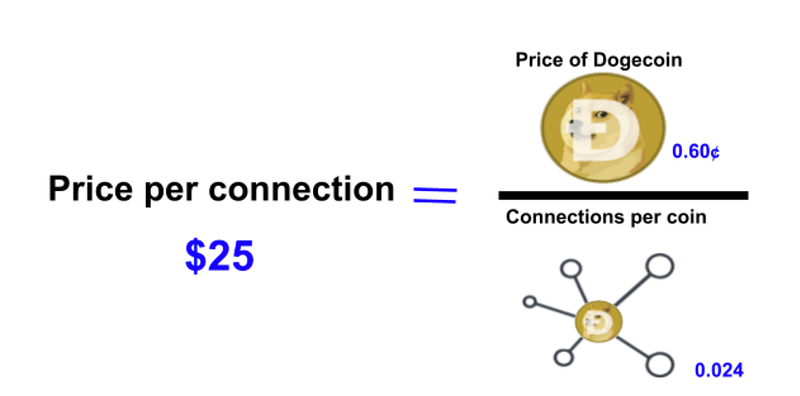

This makes sense as with increased usage and adoption, a crypto’s utility will increase. In the chart above, Bitcoin’s price per connection is valued at $1.37. Dogecoin on the other hand is valued at $11.88 times Bitcoin’s pseudo-PE value.

This means that Dogecoin is 8x overvalued when compared to Bitcoin. But if we take this with a pinch of salt, and look into a forward-looking PE approach (there will be more active users for Dogecoin in the future) as opposed to a trailing PE (when historical data defines the PE ratio).

This table above shows that Dogecoin does have an opportunity to go 13x from its current price point with further increased network density and adoption by different firms.

Final thoughts

Establishing a model to measure cryptocurrencies is difficult because neither do they operate exactly like equities nor they are acting purely as currencies. Hence, valuing cryptocurrency becomes a challenge. Trying to come up with an approach that can measure the utilitarian aspect of tokens is daunting and various empirical methods have already been tried and tested.

First, and most importantly, cryptocurrencies and the blockchain networks that generate them are not companies. They don’t have cash flows. This presents a few key problems. Notably, because of this, it’s impossible to apply the Discounted Cash Flow approach. The same goes for P/E evaluation, because cryptocurrencies are not stocks that can be evaluated by price per share. Some people argue that cryptocurrencies shouldn’t be called currencies at all because they do more than exchange value. They’re also not commodities, because they aren’t consumable. An additional difference is that the crypto market is very young, so there is little data of currencies’ past performance to use when assessing how these assets might perform in the future.

While I’m not an investment advisor and the empirical model needs to be verified a bit more, I hope that this model helps to establish a basic understanding of comparing different crypto class assets with one another.