Inflation has always been an unsexy topic. Monetary policy, fiat money, legal tender, gold standard – these are just complicated jargons for most people. But board games are sexy and fun. So let’s take a look at one of the earliest board games that you've played to explain a boring but critical subject – Inflation!

Inflation (simple definition) = Your money loses value; you can buy less things with it.

But why does money lose value? A leading driver is monetary policy. Every time the Central Bank (say Federal Reserve) prints money, the money in your wallet loses value.

But why? Because even though more money is printed, the number of goods in the world still remains the same (atleast in the short term). When more money chases few goods, what do you get? Inflation.

Then why does the Central Bank print more money? To boost the economy. To keep unemployment low. To make the government of the day look good.

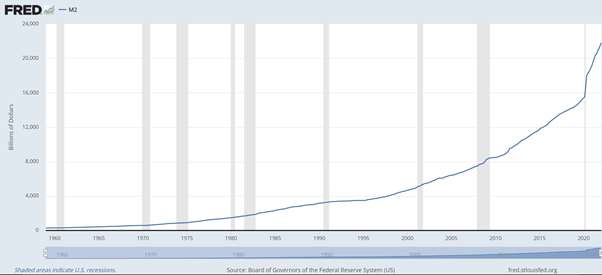

Take a look at the graph above to understand just how much money has been printed in the last two decades. Since 2008, the Fed has printed almost double the amount of dollars in existence. This was to boost the economy post the financial meltdown. In 2020 alone, 20% of all US dollars in existence were created (out of thin air – for stimulus payments). Repeat after me – When more money chases few goods, you get inflation. Your bank balance remains the same but your shopping cart gets smaller.

This sounds preposterous! Is the Fed even allowed to do this (print money out of thin air)? Actually, yes. The US left the Gold Standard system in the early 1970s and now the US dollars in the world are not tied to a limited asset (like gold). The Fed and other Central Banks can print as much money as they want.

I don’t live in America. Should I still worry about the Fed and Dollar supply? When America sneezes, the world catches a cold. Or in today’s parlance, think of it as – America tested positive for COVID and your country has been an ‘immediate contact’. Oil is produced and sold in Dollars (even outside the US), making the Dollar an important reserve currency, that all countries need to maintain large stocks of.

Ok. But what does Monopoly have anything to do with this? Clickbait title?

Now that I have your attention, let’s talk about the game that beautifully illustrates capitalism. Let’s divide the game into 3 hours.

First Hour: Every time you and your friends began a new game of Monopoly, everyone started off with a little money. So there was only a little amount of money in circulation in the economy. Unowned properties could be purchased for as little as $80 directly from the bank. But nobody had too much currency in their wallets in the beginning, and so each dollar bill had a lot of value.

Second Hour: 1 hour into the game, everyone had $80 to spare; but by this time all the properties were already taken and you had to buy them in resale from other players for say $300. Which means, the same people who barely had $80 earlier now paid four times that amount out of their wallets. Where did all this extra money in the system come from? Remember every time a player ‘passed Go’, they were given $200 by the bank. THAT IS MONEY PRINTING – More money coming into circulation. If 4 people passed ‘Go’ 3 times each during the first hour, $2,400 entered the system (Just like that! Without increasing the supply of properties) and hiked up property rates.

Third (and final) Hour: By now the game is clearly divided into the ‘haves’ and ‘have nots’. Those who own property will keep attracting the money, as other players land on their property, and those who own little property will end up ‘paying rent’ on every dice roll until they go bust. In a game, it is fun to hoot and whistle every time someone goes bankrupt, because it’s a game. In a real-life scenario, it is not fun to watch people go broke (and take to crime etc etc.)

(Image: How Billionaires should react (but don’t!) when they emerge wealthier after a lockdown)

So, what are my #Lessons (for life and Monopoly)?

1) Inflation is coming – Excessive money printing by the Fed, COVID and the Russia-Ukraine war and their resulting supply chain issues.

2) Do not hold cash during inflationary times; it will lose value. Instead stay invested in other Assets.

3) The world needs a re-think on fiat money (freely printable money). Gold is not convenient to transfer like Money, but atleast it is limited in supply and therefore a stable store of value. ‘Limited’ cryptocurrencies like Bitcoin are born out of such a need - to have a supply-capped storage of value in place.

4) The problem is not simply about money printing but also about asset ownership (and its distribution in society – 5% of society owns 85% of the wealth). The ‘new’ money (from stimulus checks) will eventually leave the hands of the asset-poor and accumulate in the hands of the asset-rich (through rent collections for example), so buy Assets to protect yourself.

5) Inflation is an invisible tax that everybody pays, and it hits the poor the hardest. To protect yourself, take an interest in personal finance; read and educate yourself on how money works.

*******

About me:

Hi I am Kapil Talwar, currently working as a Marketing Finance Manager at Zalando, based out of Berlin, Germany. I am 31 years old, originally from Mumbai, India. I hold a degree in Finance, (as well as a qualified chartered accountant) and an alumnus of IESE Business School, from the MBA class of '21.

I love to to read books on non-fiction, politics, philosophy, finance and economics. My hobbies include watching movies, as well as exploring various new cities and cultures. Hit me up on Linkedin if you liked this article or want to grab a coffee in Berlin!